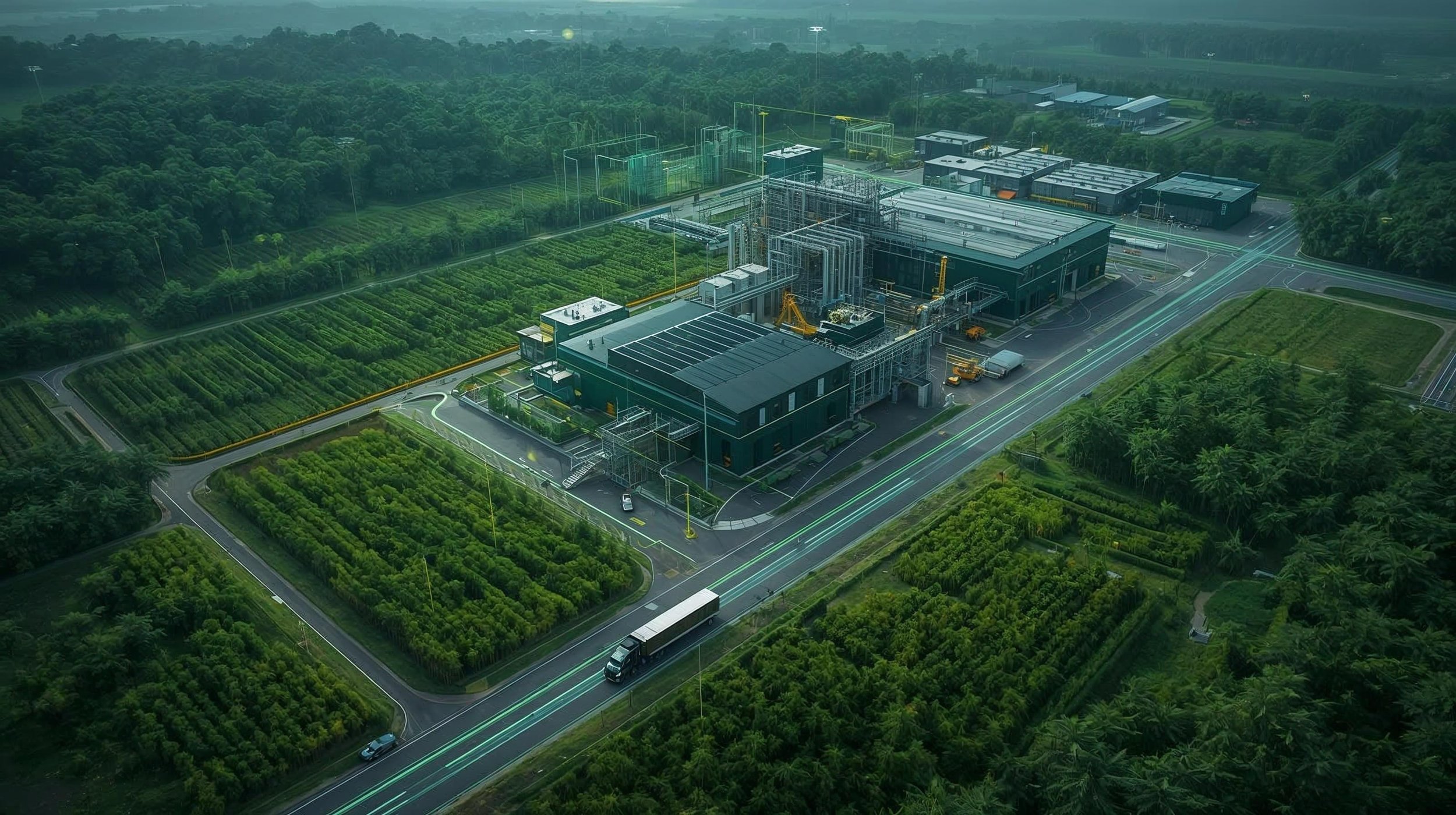

Industrial Capacity Is the Asset.

AFG develops and scales domestic industrial fiber processing capacity to supply U.S. manufacturing, defense, energy, construction, and consumer sectors requiring verified, non-FEOC, traceable material inputs.

For Investors

A new U.S. industrial asset class.

American Fiber Group builds and operates natural-fiber processing infrastructure—assets that convert hemp and bamboo into DBX-certified industrial feedstocks for construction, composites, textiles, molded components, and advanced manufacturing.

This is infrastructure with throughput, yield, margins, and multi-market demand.

AFG’s hubs function as:

Regional aggregation and preprocessing centers

Grading & certification facilities (DBX)

Fiber conversion and engineered material production lines

Industrial supply nodes feeding high-volume manufacturers

We operate at the intersection of:

FEOC risk mitigation

IRA 45X manufacturing incentives

BABA-compliant procurement

Defense supply chain reshoring

Rural industrial redevelopment

Demand is driven by structural shifts, not trends:

Automotive replacing petro-plastics

Construction moving to engineered fiber panels

Energy transitioning to composite components

Packaging leaving petroleum

Defense rewriting its China exposure

AFG’s model is simple:

Standards create trust.

Infrastructure creates supply.

Manufacturing creates scale.

Communities capture the upside.

Investors participate through:

Infrastructure financing

Facility acquisition & redevelopment

Joint ventures with OEMs

Regional hub co-ownership

Strategic expansion capital

This is the beginning of the natural-fiber industrial base in America.

AFG is the platform.

Building Demand Through Industry Leadership

AFG doesn't compete on price or ad spend. We compete on industry leadership and cause-based economic narrative.

Fiber Foundry builds demand.

Through cause-based marketing and transparent supply chain storytelling, Fiber Foundry acquires conscious consumers at lower CAC (customer acquisition cost) than ad-based competitors. Consumers choose AFG materials because they represent the new economy—domestic, regenerative, transparent. They're convinced by movement, not click-through ads.

B2B supply captures institutional demand we generate.

When procurement teams see AFG materials in consumer retail, they recognize supply chain legitimacy. When they learn that AFG materials are traceable, domestically-sourced, and carbon-verified, they see infrastructure authority. This justifies premium pricing for industrial supply contracts and enables long-term OEM partnerships competitors can't match.

Net result:

Lower customer acquisition cost through cause-based marketing + higher procurement pricing through brand authority = superior unit economics vs. commodity competitors.

The Investment Thesis

The reshoring cycle is real.

Defense, construction, automotive, consumer goods, and energy transition sectors are reorganizing around domestic content requirements and supply chain sovereignty.

The constraint is not demand.

The constraint is material capacity.

Hemp and bamboo industrial fibers are already used globally in:

Automotive components

Architectural and construction materials

Electrical insulation & EV systems

Composite reinforcement & defense applications

Packaging & molded fiber goods

The performance is proven. The applications are established.

The U.S. lacks the processing infrastructure.

AFG builds that infrastructure.

INVESTMENT HIGHLIGHTS

$250B+ Addressable Market

Automotive lightweighting, renewable energy infrastructure, defense composites, and construction materials represent combined annual procurement exceeding $50 billion across sectors where hemp/bamboo can compete on cost and performance.

Federal Policy Tailwinds

IRA 45X manufacturing credits, USDA Rural Development grants, BABA domestic content requirements, and DoD supply chain resilience mandates create structural demand for domestic biofiber processing capacity.

Strategic Optionality

Beyond core manufacturing, AFG has line-of-sight to:

Defense procurement (ballistic composites, supercapacitors, UAV components)

EPA Superfund remediation (phytoremediation + industrial feedstock conversion)

Critical materials supply chains (graphene, carbon nanotubes, biochar)

Proven Execution Model

Management team has facility acquisition, manufacturing scale-up, and B2B sales experience. Sell-first approach de-risks capital deployment by validating demand before infrastructure spend.

MARKET VALIDATION

Proven Applications with Validated Economics

Automotive Composites

Hemp fiber composites already deployed by BMW, Ford, and Mercedes-Benz for door panels, dashboards, and interior trim. 20-30% weight reduction vs. fiberglass, meeting FMVSS 302 flammability standards.

Renewable Energy Carbons

Bamboo-derived activated carbons for supercapacitors demonstrate 2× commercial performance (594 F/g vs. 300 F/g) with $50M+ military contracts already awarded to domestic producers using similar feedstocks.

Defense Materials

Bamboo/hemp ballistic composites show 22% superior performance vs. aramid (NIJ-certified), 31% cost reduction, and eliminate China supply chain dependency for critical protective systems.

Construction Materials

Hemp-lime insulation and structural panels meet ASTM C518 thermal performance standards, qualify for LEED credits, and provide carbon-negative building materials for commercial construction..

POLICY ALIGNMENT

Federal Incentives Create Structural Advantage

IRA 45X Manufacturing Credits

Advanced manufacturing production credits for domestic biofiber processing and carbon material production. Credits range from $0.75-$3.00 per pound depending on material category.

USDA Rural Development Grants

Value-Added Producer Grants (up to $250K) and Rural Energy for America Program (REAP) grants for bioeconomy infrastructure in agricultural regions.

BABA Domestic Content Requirements

Build America, Buy America mandates for federally funded infrastructure projects create preference for domestic biofiber materials in construction and energy projects.

DoD Supply Chain Resilience

Pentagon initiative to reduce China dependency in defense supply chains creates procurement priority for domestic composite materials and energy storage components.

COMPETITIVE POSITIONING

Why AFG Wins

Dual-Feedstock Advantage

Hemp (high cellulose, fast annual cycle) + Bamboo (high tensile strength, multi-year harvest) provides material flexibility and supply chain redundancy. Competitors focus on single feedstock.

Compliance-First Infrastructure

AFG builds QA/QC systems, LCA documentation, and certification pathways from day one. Competitors retrofit compliance post-production, creating audit risk and buyer hesitation.

Policy-Aware Capital Deployment

Every facility acquisition and product line maps to specific federal incentives (IRA 45X, USDA, BABA). We don't build infrastructure hoping for policy support—we build where policy already points.

Vertical Integration Without Greenfield Risk

Acquire existing facilities (particle board, molding) and retrofit for biofiber processing. Avoid 3-5 year greenfield timelines and permitting risk while securing immediate capacity.

Blended Finance:

Carbon Verification Reduces Cost of Capital

AFG operations generate verifiable carbon sequestration as a natural outcome of industrial hemp and bamboo cultivation. This unlocks cheaper capital through federal matching, state climate funds, and green financing structures.

Three federal/state funding mechanisms reduce private capital requirements:

EPA Superfund Partnerships

Carbon credit revenue subsidizes remediation costs. EPA prioritizes projects generating carbon offsets. AFG facilities automatically qualify, reducing project economics burden on federal budgets.

Impact: 10-15% reduction in remediation costs through carbon revenue.

USDA Conservation Funding

Perennial plantings generate soil carbon credits eligible for USDA carbon farming programs. Effectively reduces grower input costs.

Impact: $15-30 per acre annual subsidy to growers.

State Climate Funds

Most states allocate capital to projects with verified carbon reduction. AFG facilities qualify for 15-40% matching funds, directly reducing private capital required.

Example: $10M facility investment → $2-4M state climate matching funds → Net private capital required drops to $6-8M.

Result for investors: Blended capital structure reduces private equity IRR requirements from traditional 20%+ to sustainable 15-18% with federal/state co-funding participation.

Why the Timing Is Now

Five structural forces are driving accelerated capital migration:

FEOC restrictions limiting China-dependent sourcing

Domestic content incentives in grid, EV, and public infrastructure

Defense procurement requirements for U.S.-origin materials

Scope 3 carbon reporting and traceability mandates

Reliability + price stability replacing lowest-cost sourcing

This is not a trend.

This is policy-backed industrial restructuring.

Revenue Channels

Revenue Channels: Antifragile Multiple-Stream Model

AFG doesn't rely on a single revenue channel. The business model stacks revenue across industrial, consumer, climate finance, and government co-funding streams.

Year 1 Economic Model (per 1,000 acres deployed):

Primary Revenue: Industrial Materials (B2B)

Particle board, composites, textiles, filtration → Manufacturers, OEMs, builders

$1,600,000 annually

Margins: 35-50%

Customer base: Fortune 500 OEMs, industrial converters, regional builders

Contract type: Multi-year supply agreements (DBX-indexed pricing)

Secondary Revenue: Consumer Brand (B2C via Fiber Foundry)

Apparel, home furnishings, building materials → Direct-to-consumer, specialty retail

$200,000-300,000 annually

Margins: 30-40%

Customer base: Conscious consumers, sustainability-focused retailers

Strategic value: Demand generation + brand moat for B2B

Financing Benefit: Carbon Verification

Biogenic carbon credits (Verra, ACR) → Energy companies, OEM carbon offset buyers

Soil carbon programs (USDA) → Long-term conservation contracts

Avoided emissions (OEM Scope 3) → Automotive, aerospace OEMs

$200,000-350,000 annually

Reduces blended cost of capital via federal matching + green financing

Government Co-Funding: EPA Superfund & USDA

Remediation contracts (Superfund sites) → EPA cost-sharing

Conservation programs (soil health) → USDA matching

Regional development programs → State/local economic development

$50,000-100,000+ annually (variable)

Direct subsidy to operational costs

| Revenue Stream | Customer/Partner Type | Annual Value (1,000 acres) |

|---|---|---|

| Industrial Materials (B2B) | OEMs, Manufacturers, Builders | $1,600,000 |

| Consumer Brand (B2C) | Fiber Foundry DTC, Retail | $200,000-300,000 |

| Carbon Verification | Carbon funds, OEM buyers, USDA | $200,000-350,000 |

| Government Co-Funding | EPA, USDA, State programs | $50,000-100,000+ |

| Total Economic Value | Diversified Channels | $2.05M - $2.35M |

Why Revenue Diversification Matters:

AFG's revenue model is antifragile: Multiple customer types (B2B industrial, B2C consumer, government agencies, climate funds), multiple contract types (fixed volume, carbon-indexed, cost-share), multiple geographies (regional + national).

This diversification reduces customer concentration risk and creates non-correlated revenue streams:

When B2B contracts slow, carbon credits accelerate

When material pricing softens, government matching funds increase

When consumer demand peaks, it funds B2B infrastructure expansion

When one sector (automotive) contracts, another (defense) expands

Result: Predictable, stable cash flow across economic cycles and sector volatility.

Regional Industrial Development

Industrial fiber processing plants function as anchor employers in regional economies, similar to historical steel, paper, and lumber hubs.

They create:

Multi-tier manufacturing job ecosystems

Stable raw material purchase agreements for rural suppliers

Expanded local tax base and contracting activity

Qualification for state and federal economic development incentives

Where material processing capacity returns, manufacturing follows.

Climate Benefit as Capital Leverage

AFG is not a climate company.

We are an industrial capacity builder.

However, the carbon-negative and low-input nature of hemp and bamboo fibers qualifies our facilities for:

Green bank and DOE industrial decarbonization financing

State-level EDC matching capital

USDA & EPA rural development and remediation funds

Workforce development and apprenticeship grants

Blended finance structures that reduce cost of capital

Climate impact is the co-benefit, not the motive.

It is the lever that lowers deployment cost and accelerates scaling through matched public and private capital.

Our Model

-

Acquire Strategic Facilities

Target underutilized industrial sites to reduce capex and commissioning timelines.

-

Upgrade & Scale Processing Lines

Fiber refinement, pulp, composite feedstocks, and carbonization capacity engineered for throughput and standardization.

-

Secure Domestic Feedstock Supply

Contracted grower networks and regional aggregation ensure stability and traceability.

-

Standardize Industrial Inputs

Produce spec-grade materials compatible with existing manufacturing systems.

Primary Return Drivers:

Acquisition arbitrage on undervalued industrial assets

Throughput expansion and material standardization

Long-term supply agreements with OEMs and Tier 1 manufacturers

Pricing premium for certified, domestic, non-FEOC fibers

Incentive alignment reducing cost of capital

Strategic Leverage:

Defense supply chain independence

Verified carbon and traceability pathways

Eligibility for domestic content procurement

Regional manufacturing revitalization incentives

Request the Investor Briefing Deck

Access the full acquisition model, facility roadmap, financial structure, and deployment timeline.